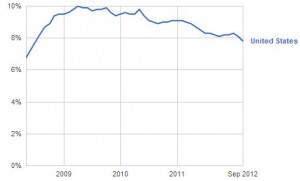

For those of you who read my posts on a regular basis you know I have a deep respect for President Reagan. Not the Reagan fantasized by the Tea Party today but the real Reagan that negotiated with the left instead of holding them hostage, was liberal on social platforms, and used religion only as a tool in the Cold War. Last night I was taking my wife through 30 years of unemployment (yes, I am a boring husband) and was startled by a very remarkable similarity. With yesterday’s unemployment rate announcement, President Obama’s and President Reagan’s first term curves are basically identical.

Both presidents inherited skyrocketing unemployment rates and both, through different measures, were able to start moving the economy again and experienced significant job gains the back half of their first terms. Both presidents inherited 8% employment rates, watched them climb to 10%+, and then fall again to high 7%. Reagan’s dramatic direction change came behind Paul Volcker’s handling of the Federal Funds Rate, which dropped from 19% in 1981 to 8.5% in 1982 freeing up cash and driving significant capital investment. President Obama also has help from the Fed through quantitative easing and driving demand through deficit spending.

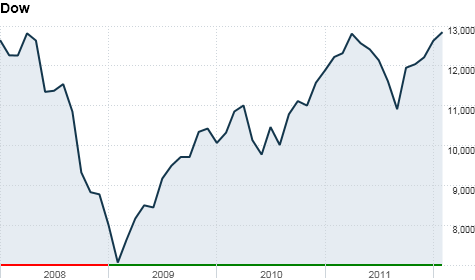

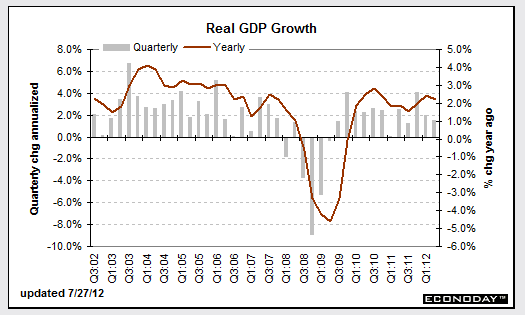

What shouldn’t be overlooked, is with the national unemployment rate falling below 8%, almost every economic metric is now better than when President Obama took office. GDP is growing again after watching significant drop in production. The Dow is back to pre-bubble levels and has climbed dramatically in the last three years largely due to record corporate profits. Now the only argument the right has is the skyrocketing national debt, but as I demonstrated here this has very little to do with President Obama’s legislation.

If some of your older Republican friends have a problem with the unemployment curve under President Obama, ask them if they voted for Reagan in 1984. If any of your friends ask if we are better off now than four years ago, feel free to engage in that conversation.

Graph monthly job growth in year 4 of Reagan v. Obama.

I dare you.

Ed

I look at your first graph there and I see a flat, stagnant, record breaking unemployment rate on one hand, and on the other I see the spike and drop of a traditional recession and recovery. The Obama graph is missing that recovery portion. What am I missing?

I agree that the recovery under Obama is not as aggressive as Reagan, but as I pointed out earlier, Paul Volcker dropped Fed rates almost 10% in the space of 18 months. When cost of borrowing drops at such significant slopes, the economy will instantly kick start with little help from any White House policy (like stimulus spending).

Rates have been at historic lows for years now (lower than Volcker’s rates). It’s not the slope at which rates have come down but the accessibility to cheap money that is “supposed” to kick start our economy. We also went through two rounds of stimulus, QE1, QE2, and now QE3. These measures didn’t work and will just continue to monazite the debt which is their real goal; tax in and of itself.

I applaud business insider for taking my charts to a whole new level 😉

http://www.businessinsider.com/consumer-comeback-2012-10

In 1994, the BLS changed the way in which it counts “discouraged” workers for the U-3 index. If one is unemployed for more than 52 weeks, even if one continues to look for employment, one is dropped from the labor force. A smaller denominator with the same number employed leads to a higher employment rate and a lower unemployment rate. Ask yourself how much sense this makes in today’s world where the average unemployment duration is 40 weeks and there have been several years where unemployment benefits last for 99 weeks